BankBeat stock image

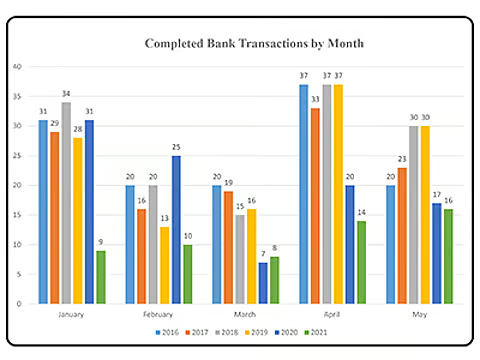

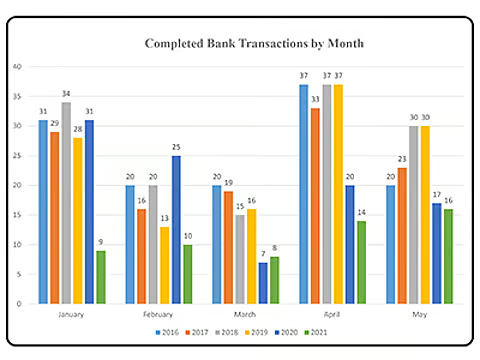

After a healthy number of transactions at the start of the 2020 coronavirus pandemic put most M&A discussions on hold across corporate America, including banks. The graph, Completed Bank Transactions by Month, compares the number of completed bank transactions in the first five months of each of the last six years. The number of transactions decreased in 2020 and generally remains lower than historical levels through the first five months of 2021. Continued uncertainty remains regarding M&A activity throughout 2021.

Despite the slowdown in M&A activity, the broader bank indexes have recovered from the lows they experienced in mid-March of 2020. The recovery of the SNL Bank Index over the last several months mirrors that of the broader market; however, we believe community bank valuations may continue to be subject to some volatility throughout 2021.

While banks are generally better capitalized at the start of the pandemic than they were at the start of the 2008-09 recession, the extent of future pandemic-related credit losses remains unknown. Those banks with greater exposure to retail and hospitality faced the greatest risks over the last year. However, as vaccines have become available through the first half of 2021, more cities and states are beginning to open up and lift their restrictions, benefitting the aforementioned retail and hospitality industries the most.

Michael Klinger is assistant vice president, BankValue manager – BankValue Advisory Services, United Bankers' Bank, Bloomington, Minn.