Chronicles

Community bank income rises amid increases in net interest, noninterest income

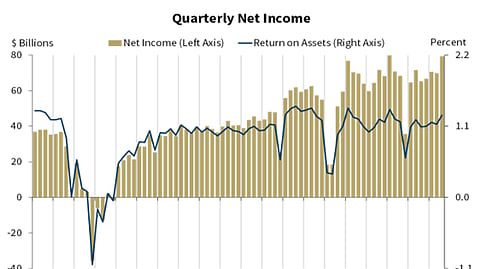

Community bank net income increased 10 percent to $8.4 billion in the third quarter of this year, according to the FDIC third quarter banking profile.

Community bank net income increased 10 percent to $8.4 billion in the third quarter of this year, according to the FDIC third quarter banking profile.